Non-Interest Banking and Finance: BoG Initiates Processes to Absorb Framework

Story: GEORGINA APPIAH

Islamic or non-Interest Banking is a form of banking that complements conventional banking and finance in mainly secular economies.

According to experts, Muslims and non-Muslims can benefit from the services and products of Islamic banking.

The system promotes the values of ethical investment as recorded in Sharia law.

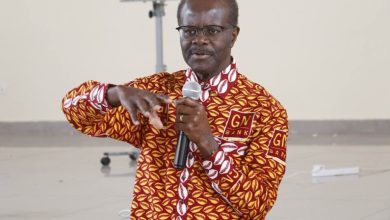

The Advisor to the Bank of Ghana, Professor John Gartchie Gatsi, states that non-interest banking is a part of the global financial architecture in which interest is prohibited and transactions are based on profit and loss sharing among parties.

He indicates that activities such as gambling, casinos, among other related ventures are frowned upon by this form of banking.

“Islamic finance includes: Banking, Microfinance, Capital, market, Fintech, Insurance , Venture capital , Trade finance, Business development, sovereign and private sector project finance among others”.

Prof John Gatsi further explains that non-interest banking is commercial banking and contributes strategically to the economy, deepens financial inclusion, promotes SDG, and ethical obligation towards protection of the environment.

As the Bank of Ghana (BoG) initiates processes to regulate non – interest banking in the country, a series of consultations with stakeholders is being organized to sensitize the public on the significance of Islamic Banking.

One of such engagements was held on Saturday 19th July, for selected journalists across the country in Korforidua in the Eastern Region of Ghana, to educate them on the phenomenon.

“Consultations ensure stakeholders are well informed to legitimize a policy because their input is significant and the media is particularly important because they can educate the public on the importance of non-interest banking and finance”, Professor John Gatsi told journalists.

The Non-Interest Banking system is expected to attract Foreign Direct Investment and real sector development.

It also hopes to among other things Finance Infrastructure Projects, Improve Socio-Economic activities, Increase economic growth and development and Support trade and export.

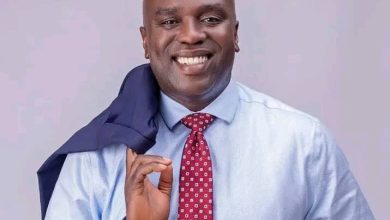

In an address, the Head of Banking Supervision Department, BoG, Mr Ismail Adam, who represented the Governor of the Bank of Ghana, stated the stakeholder engagement series was vital towards establishing the institutional, legal, and regulatory framework, necessary for the operationalization of Non-Interest Banking and Finance (NIBF) in Ghana.

He established the fact that the objective of the workshop was to build capacity within the media fraternity, empowering journalists to support public education and enhance financial literacy on matters relating to NIBF.

Mr Ismail Adam explained that “non-interest finance remains largely untapped banking and financial opportunity in Ghana”.

”In light of the structural constraints facing our economy, ranging from high graduate unemployment, sluggish GDP growth, significant infrastructure gaps, and limited fiscal space; NIBF presents a valuable opportunity to diversify both our financial system and sources of funding”, the Head of Banking Supervision at BoG stressed .

He further pointed out that “what began as a niche complement to conventional finance in the 1970s has evolved into a significant pillar of the global financial system. As of 2024, the NIBF industry surpassed a major milestone, with global assets exceeding USD 5 trillion, representing a 12% increase over 2023 and a 43% growth since 2020”.

“Core principles of NIBF, which are ethical conduct, transparency, and the exclusion of harmful or unethical activities, strongly resonate with the Environmental, Social, and Governance (ESG) agenda. NIBF aligns well with the United Nations Sustainable Development Goals (SDGs), particularly in advancing environmental stewardship, social equity, and inclusive growth. For instance, the principle of wealth protection directly relates to SDG 8 on decent work and economic growth, and SDG 10 on reducing inequalities”.

According to Mr Ismail Adam, the sector had seen impressive expansion, with over 1,980 Islamic financial institutions now operating across more than 90 markets (both majority and minority Muslim countries).

He disclosed that a number of sub-Saharan African countries, including; Nigeria, Kenya, South Africa, The Gambia, Ethiopia, Malawi, Uganda, and more recently Eswatini had taken significant steps towards integrating NIBF within their financial systems.

“In Ghana, the promise of NIBF is compelling for several reasons, which include; inclusivity. NIBF can significantly broaden financial access, particularly for underserved populations. Its risk-sharing features and linkages to tangible assets make it especially suitable for SMEs and startups, which are key drivers of inclusive economic growth”.

On Infrastructure Financing; the structure of NIBF products lends itself well to infrastructure investments, catalysing productivity and high-value economic activity. This can boost investment in infrastructure to support Ghana’s economy, society and daily life.

NIBF ensures Financial Stability: The asset-backed nature of NIBF and its lower leverage structure contribute to a more stable financial system. Profit-sharing and loss-absorbing instruments can enhance resilience during financial stress, aligning with modern regulatory goals of higher total loss-absorbing capacity.

Mr Ismail Adam therefore stated that the opportunities presented by NIBF for new markets like Ghana, was enormous and could attract a broader base of users, regardless of religious affiliation.

“This is precisely why the Bank of Ghana has constituted a dedicated team to develop a comprehensive policy framework for the operationalization of NIBF in Ghana”, he emphasized.